Personalized Portfolios

We recognize every investor is unique. That’s why we create a personalized portfolio tailored to your specific goals and objectives.

Our Investment Approach

David Swensen, the head of the Yale Endowment Fund, is one of the most recognized professionals in the investment industry.

We build and manage your portfolio based on his three rules. In his book, Unconventional Success, he suggests the following:

Asset Class Diversification

Investors should maintain exposure to six core asset classes for diversification. These asset classes include domestic equities, emerging market equities, international equities, government bonds, real-return bonds, and real estate.

Regular Rebalancing

Investors should rebalance the portfolio on a regular basis. This involves moving money between investments to ensure your portfolio composition remains aligned with your goals and risk tolerance.

Invest into low-cost Index Solutions

The investor should, in the absence of a confident market-beating strategy, invest in low-cost index funds and ETFs.

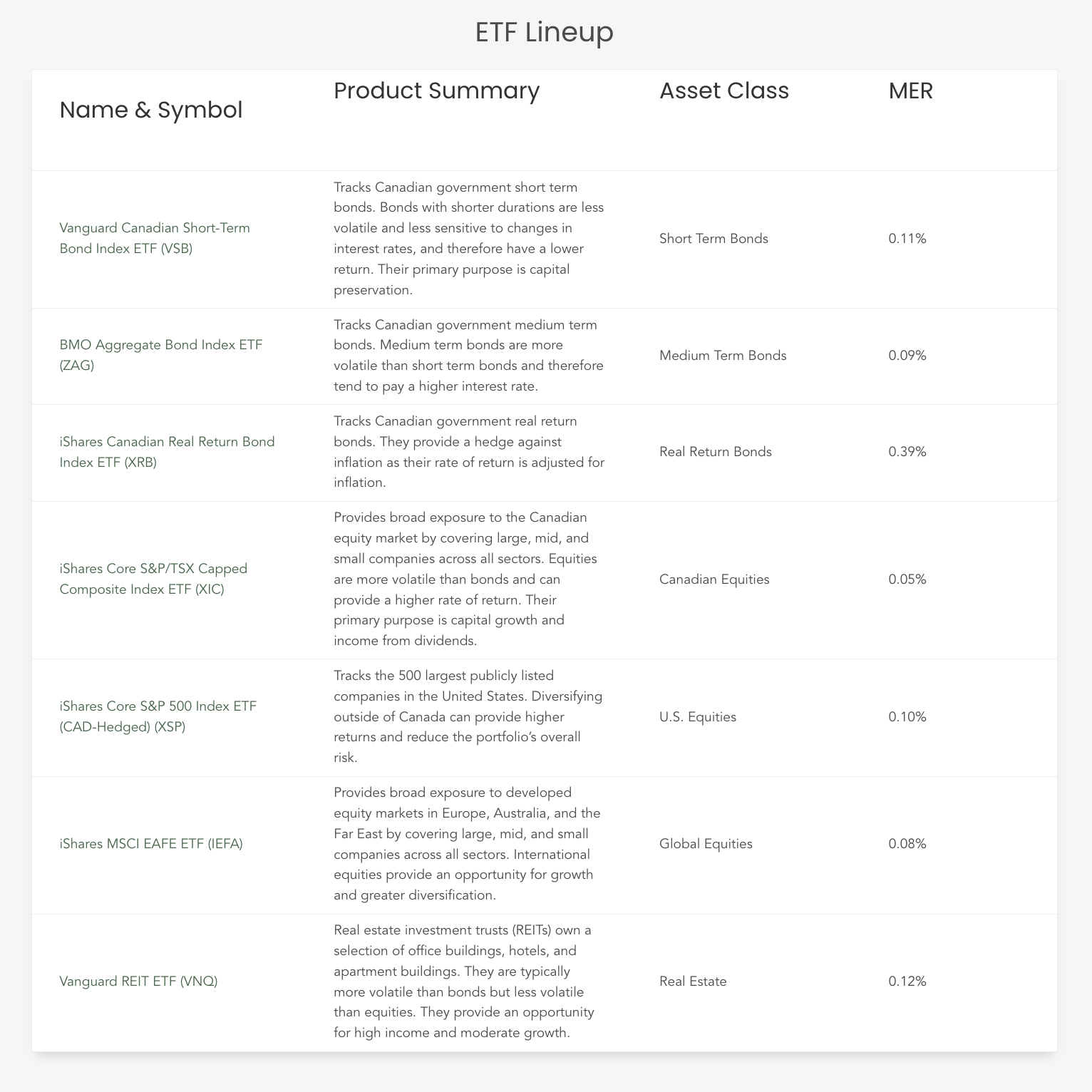

Using innovative technology and industry-tested investment rules, Nest Wealth creates a low-cost diversified portfolios built specifically for your life goals. Once you’re invested, we take care of monitoring and rebalancing your portfolio so you can get on with enjoying your life. We build your investment portfolio from seven different ETFs that represent seven different asset classes. You’ll own a different proportion of each of these ETFs based on your risk score, which takes into account what you’re saving for, when you’ll need the money, and how reactive you are to market ups and downs.

Exchange-Traded Funds (ETFs)

ETFs are a low cost and effective way to build a diversified investment portfolio. They allow you to gain exposure to a variety of asset classes like bonds, equities and real estate. Many ETFs track well-established indices like the S&P 500 or TSX and can provide diversification across many markets at a low cost.

ETF Selection Process

We select what we believe are the best ETFs available in each asset class, making sure they work well together. We look for ETFs that are low cost, liquid, and have a low tracking error to their underlying index.

Low management expense ratios (MERs) mean you pay less in fees so you keep more of your returns (more wealth for you!). High liquidity means your portfolio is easier to rebalance and your money is readily accessible when you need it. Finally, a lower tracking error just means the ETF is more efficient at its job of mimicking an index.

Asset Classes

Asset classes act as the foundational building blocks of a diversified portfolio. Your asset class allocation is determined by your risk tolerance, investment objectives and other personal circumstances. In general, a longer time horizon (or objective of capital growth) will yield more exposure to risk assets (such as equities and real estate) relative to shorter investment time horizons (or objectives of capital preservation).

Benefits of Diversification

Maintaining portfolio diversification can help reduce risk and improve returns. At Nest Wealth, we create portfolios that are globally diversified across different sectors and economies using Nobel-prize winning principles to help you maximize risk-adjusted returns.*

Automated Rebalancing

Creating your customized portfolio is only the starting point of a successful investment strategy.

Every step of the way Nest Wealth will help make sure you are working towards your financial goals. This is done in three steps:

Step 1

Nest Wealth develops your customized ideal asset allocation based on your personal risk tolerance, your objectives and your current financial situation.

Step 2

As the market moves up and down, your portfolio’s asset allocation can drift away from your target asset mix. Our technology helps us monitor these developments.

Step 3

If an asset class rises too much, Nest Wealth will sell some. The proceeds will be used to buy other assets and restore your ideal asset allocation.

The Low-cost Advantage

Why Passive?

Overwhelming research shows that passive investing is an effective way of growing your money over the long term by helping you keep investment costs low and stay diversified. Using this as our foundation, we build your portfolio to “be the market” rather than try to “beat the market”.

Invest like a Pro

To increase their odds of success, well-known investors such as Burt Malkiel, Jack Bogle and David Swensen focus on proper diversification, systematic rebalancing, appropriate risk and reducing fees. By keeping portfolios diversified and low cost, you can minimize investment risks while maximizing rewards over the long term.

“Being the Market”

Passively managed investments are referred to as “index funds” because they’re tied to an index that represents a particular market. For example – an S&P 500 ETF would provide exposure to the S&P 500 index which measures the stock performance of some of the largest American companies in the world. That’s why passively managed index funds exist. They track and mimic the movement in the index by investing in all or some of the securities held in that index. With passive investing, your money is used to buy shares in a category of companies and that category is called an index. If that category of companies collectively performs well, so will the index and you will see the direct benefits of that in your account.

*Our portfolios are constructed using Modern Portfolio Theory which was awarded the Nobel Prize for Economics in 1990 based on a a thesis developed by Harry Markowitz. Modern Portfolio Theory uses variables such as expected return, expected volatility, and correlation of asset classes to develop an optimally weighted portfolio.